Six Money Challenges to Try this Year Broke On Purpose®

1.5 Biweekly Money Saving Challenge 1.6 $5,000 Savings Challenge 1.7 $10,000 Saving Challenge 1.8 $20,000 Savings Challenge 1.9 The Penny Challenge 1.10 Necessities only for 30 days 1.11 Spare change challenge 2 FAQ 2.1 Where should you keep the money you are saving? 2.2 What are the benefits of a money saving challenges?

11 Money Saving Tips I Used to Save 15,000 Last Year Money saving challenge, Money saving

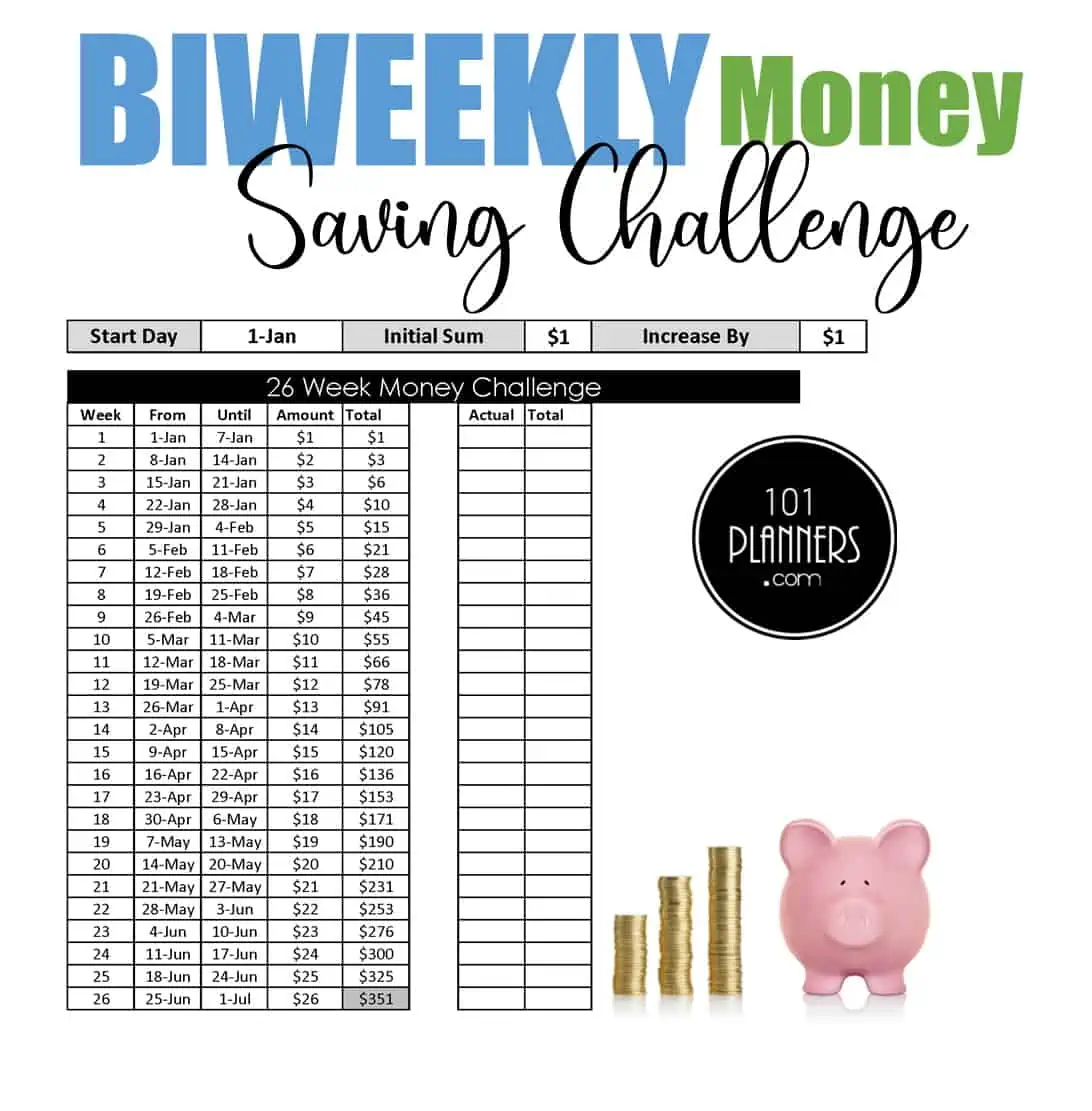

The biweekly money saving challenge is a plan to save money every other week. This can be customized depending on your personal circumstances, such as whether you prefer smaller amounts saved every week or larger amounts saved over a longer period of time.

Pin on Save Money

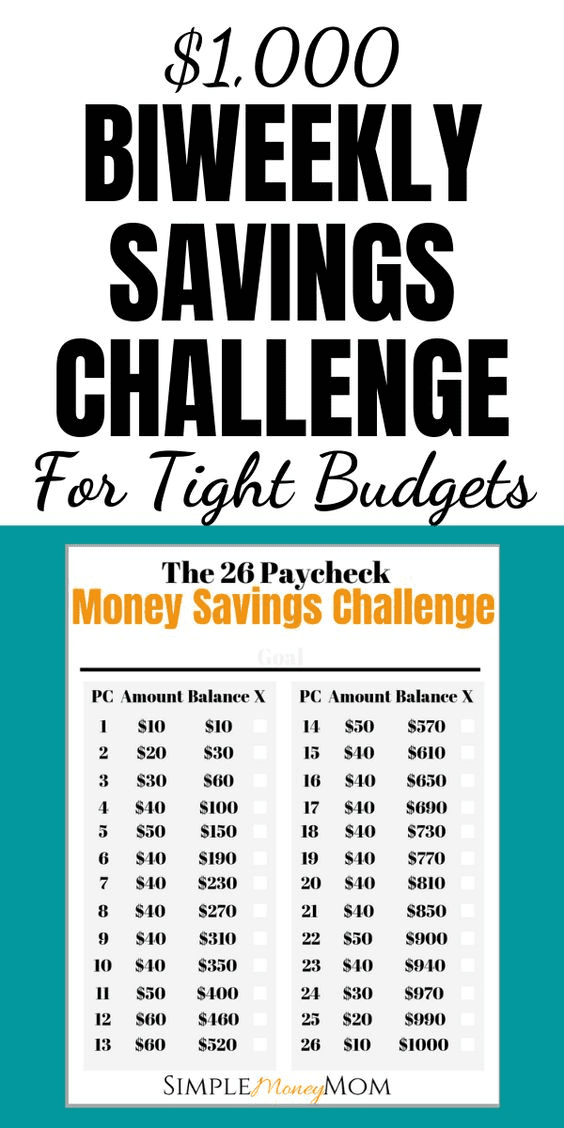

The biweekly money-saving challenge has emerged as an effective strategy for individuals to develop consistent savings habits and achieve their financial goals. By aligning savings with biweekly paychecks, this challenge provides a structured framework that enables individuals to make regular contributions towards their savings, ultimately.

Quick and Easy Money Saving Challenges · Poor In A Private Plane Saving money budget, Money

Many people start with a low number, bumping up each week by $5 increments. Your biweekly savings would look like this: First two weeks: $5. Second two weeks: $10. Third two weeks: $15. Fourth two weeks: $20. And so on, until you reach the 13th pay period and hit $455. Throughout your one-year challenge, you would bank $1,655.

.png)

BiWeekly Savings Challenge

The bi-weekly savings challenge is a way to save money by setting aside a small amount of money every two weeks. The idea is to make saving money a habit, rather than something you only do once in a while. This works perfect for those who are paid bi-weekly or every two weeks. How Does the Bi-Weekly Savings Challenge Work?

Benefits of Participating in a Biweekly Money Saving Challenge

A biweekly money-saving challenge is a structured plan that prompts you to save a certain amount every two weeks (14 days). Whether you receive your paycheck biweekly or monthly, this challenge is designed to help individuals build the habit of saving by setting achievable yet slightly stretching targets.

21 Money Saving Challenges to Try in 2023 finansdirekt24.se

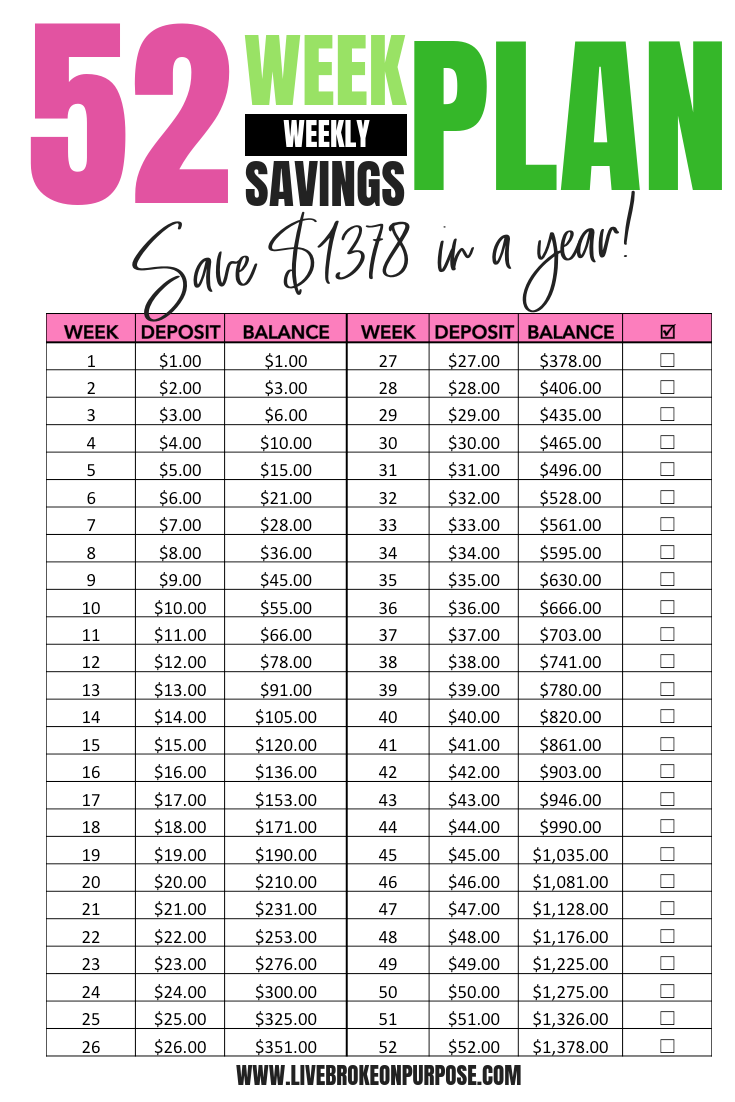

Here are fifteen 52 week money saving challenge ideas to kickstart your goals! These weekly savings plans can really help you turn your finances around. When it comes to bothersome tasks like saving money, it helps to make it a game. These money saving challenges are simple and straightforward.

Bi Weekly Money Saving Challenge Printable

The Biweekly Money saving challenge is a great one to start with. It requires putting away cash for 26 weeks or every other week for one year. The amount you choose to save can vary based on your goals and comfort level. Types of Biweekly Money Saving Challenges If you're paid bi-weekly, this plan type might suit your lifestyle best.

This unique money saving challenge is perfect for those who get paid biweekly. There are 26

The 26 Week Money Saving Challenge Maker is a fantastic resource for those looking to embark on a biweekly savings journey. With this user-friendly tool, you can create a customized savings plan that spans over two weeks. You have the freedom to select your preferred savings amount, ranging from a minimum of $1 to a maximum of $100.

Pin on Money saving plan Saving money budget, Money saving plan, Money saving strategies

What Is a Biweekly Money Saving Challenge? Which Biweekly Money Saving Challenge Should I Try? More Money Saving Challenges I Started My Biweekly Money Saving Challenge. Now What? Final Word on Money-Saving Challenges Biweekly Money Saving Challenge FAQ Why Would I Even Need a Money Saving Challenge?

52 Week 5000 Money Challenge Printable Take Control of Your Finances with Ease!

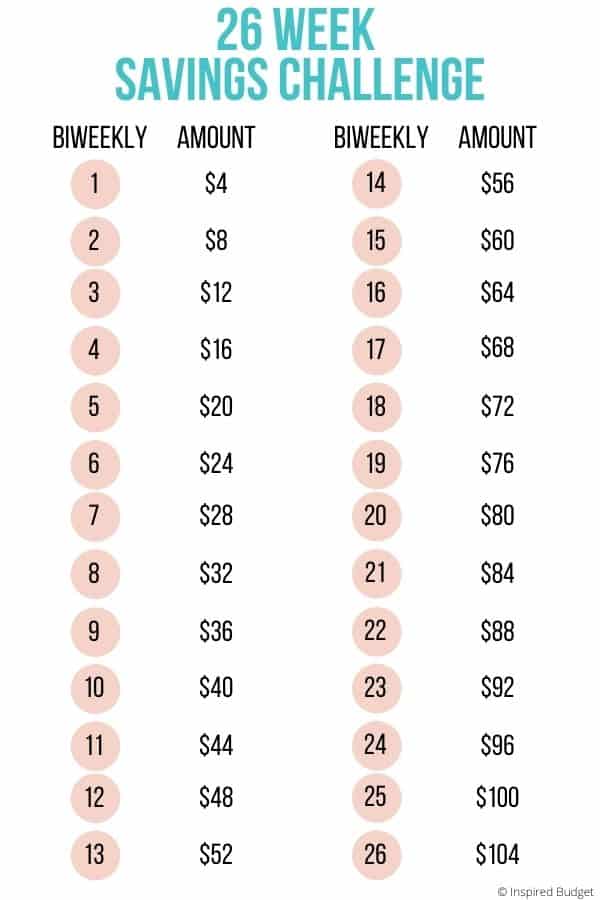

In the 26-week biweekly money-saving challenge, you can save $1,404 in a year by depositing an increasing amount every other week. Start with $4 on the first week and $8 on the second. Add an extra $4 every two weeks until you deposit $106 on week 26. 10. Money throw-down challenge.

40+ Money Saving Challenges to Start Today

What Is a Biweekly Money-Saving Challenge? Savings challenges are often designed around pay cycles, so a biweekly money-saving challenge requires you to put money away every two weeks — or for your next 26 paychecks. Here are some biweekly challenges for anyone who can't seem to save or successful savers who want to boost their savings.

52 week money challenge biweekly 52 week money challenge, Money challenge, Money saving challenge

Saving Money 21 Money Saving Challenges to Try in 2023 By Allison Baggerly February 12, 2023 Saving money doesn't have to feel boring or difficult! If you are looking for a money-saving challenge, this is the most complete guide you will find. These 20-plus money challenges for 2022 will help you save big!

Biweekly Savings Plan Save 5000 in 26 Weeks Modern Design Saving money budget, Money

Customize Your Biweekly Savings Challenge. If you want to bump up your savings faster than the $3 biweekly money saving challenge, then try increasing the dollar amounts just a bit. For instance, if you saved $4 increments, you could save $1,404, and if you did $5 per pay period, you could save $1,755 at the end of the challenge!

5K 26 Week Savings Challenge Biweekly 5K Savings Etsy

A bi-weekly savings challenge is a financial strategy where individuals commit to saving a specific amount of money every two weeks (bi-weekly). The goal of this challenge is to encourage regular savings habits and gradually accumulate funds over time.

Top 10 Fun & Easy Money Savings Challenges for 2019 Money saving strategies, Money saving

A biweekly money saving challenge is a challenge where you save a set amount of money every other week. They are perfect for people who are paid biweekly and want to save something with every paycheck. Biweekly savings challenges can be done with any amount of cash and for different time periods depending on what you want to achieve.